|

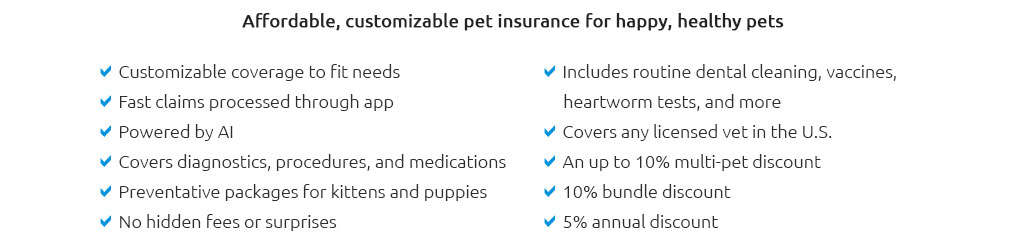

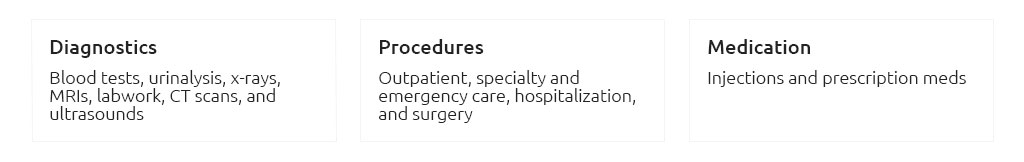

what dog insurance covers in plain terms for real-life decisionsThe quick pictureIt covers the big, expensive stuff first: accidents and illnesses. Think broken legs, swallowed socks, infections, allergies, chronic issues, even cancer. The point is simple - save money and gain confidence when the vet says, "Here's the best treatment." Typically covered, with real impact- Emergency care: ER exam fees, triage, stabilization after accidents.

- Diagnostics: X-rays, ultrasound, bloodwork, advanced imaging when needed.

- Surgery and hospitalization: From foreign body removal to ACL repair, plus monitoring.

- Prescription meds: Antibiotics, pain control, allergy meds, cancer drugs.

- Chronic and hereditary conditions: Diabetes, hypothyroidism, hip dysplasia - if not pre-existing when you enrolled.

- Specialists and referrals: Cardiology, oncology, neurology.

- Rehabilitation and alternative therapies: Often covered when prescribed; acupuncture or laser therapy may be included on some plans.

- Travel emergencies: Many policies pay at any licensed vet; sometimes even when you're out of state. I almost said "any vet anywhere" - more precisely, most plans accept any licensed vet in the U.S., and some extend beyond.

- Dental trauma: A cracked tooth from a chew gone wrong is usually covered. Dental illness is different - see below.

Sometimes covered or offered as add-ons- Dental disease care: Periodontal treatments may require a dental add-on and proof of routine cleanings.

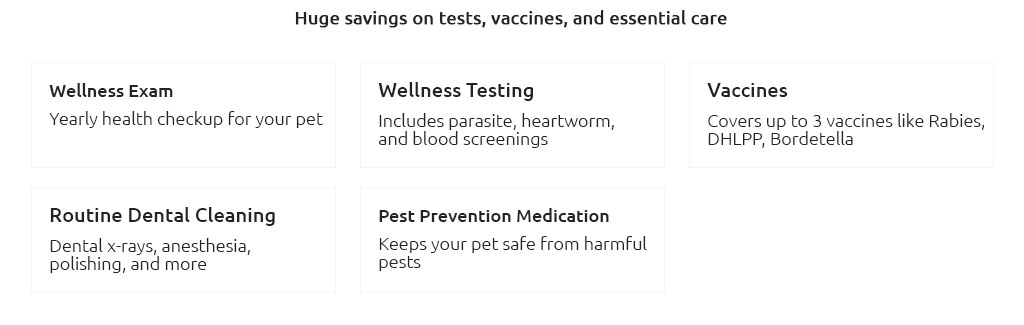

- Wellness/routine care: Vaccines, flea/tick prevention, annual exams are usually not in base illness/accident plans; wellness packages are optional. I nearly called this "covered," but to be precise, it's a separate rider with many insurers.

- Behavioral therapy: Sometimes included when a vet diagnoses a medical cause or prescribes treatment.

- Prescription diets: Occasionally covered for a set period if treating an illness.

- End-of-life care: Euthanasia is often covered; cremation/memorials vary.

Usually not covered (so you're not surprised)- Pre-existing conditions: Signs or symptoms before enrollment or during the waiting period.

- Routine and preventive care: Unless you add wellness.

- Breeding, pregnancy, and cosmetic procedures: Typically excluded.

- Grooming and supplies: Non-medical costs don't count.

- Experimental treatments: Anything not recognized as standard of care.

How the money actually worksYou pay the vet, then file a claim. After your deductible, the plan reimburses a percentage, up to your annual limit. Here's where savings show up. - Example bill: $2,400 for surgery and meds.

- Deductible: $250 once per year.

- Eligible amount: $2,400 − $250 = $2,150.

- Reimbursement rate: 80%. You get $1,720 back, you pay $680. That's real cushion - and confidence to choose the better treatment, not just the cheapest.

A real-world momentFriday night, your dog limps after the park. ER visit, sedation X-rays, pain meds: $980. You submit photos of the invoice in the app; four days later, the deposit lands. You exhale, approve the recommended follow-up, and keep your savings plan intact. Choosing scope without stressIf you mainly fear big accidents, an accident-only plan can shield savings. For broader confidence, go comprehensive (accident + illness) and make sure hereditary conditions are covered. Pick a deductible you can handle today and a reimbursement rate that balances premium with payoff. No need to over-tune - choose a sensible middle and move forward. Small clarifications that matter- Waiting periods: Coverage starts after brief waits; cruciate injuries may have longer ones.

- Networks: Pet insurance rarely restricts you to certain vets; licensed providers are usually fine.

- Liability: Damage your dog causes to others is typically a homeowners/renters insurance topic, not pet health insurance.

- Curable pre-existing issues: Some insurers reconsider them after a symptom-free period, but chronic conditions generally stay excluded.

Bottom lineIt covers the costly, unpredictable health events so you can protect savings and act with confidence. That's the value worth locking in.

|

|